What is a Real Estate Fund?

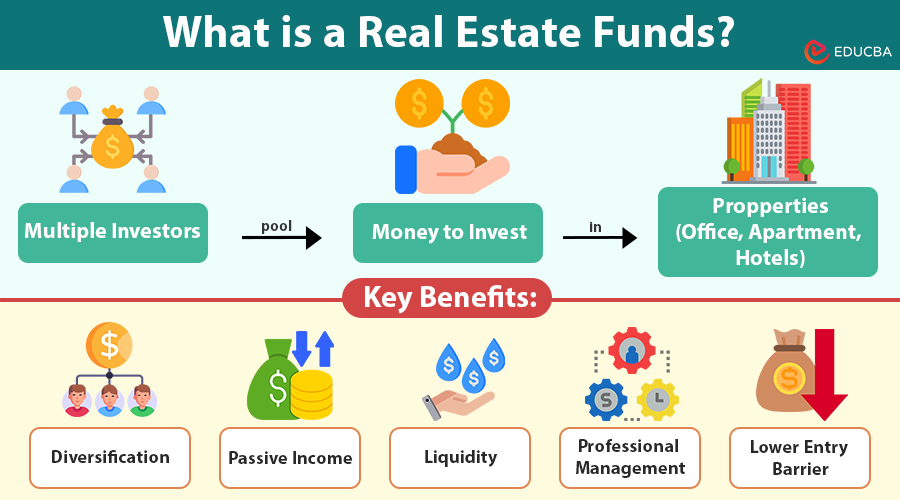

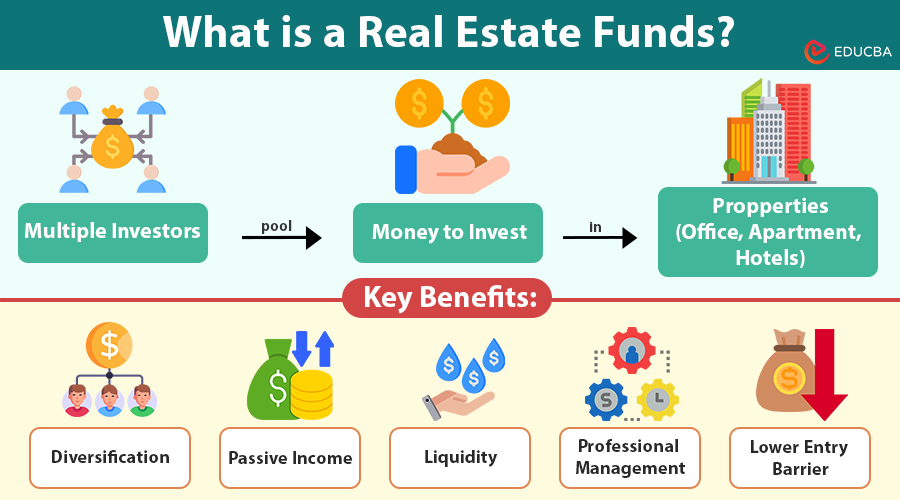

A Real Estate Fund is a way for many investors to pool their money to buy, manage, or invest in properties such as office buildings, apartments, hotels, or warehouses.

For example, imagine 100 people each invest ₹50,000 into a real estate fund. The fund then uses the ₹50 lakh collected to purchase a rental apartment building. Investors receive returns from the rent tenants pay, while professionals manage the property, allowing investors to earn without handling tenants or repairs.

Table of Contents

Key Takeaways

- Real Estate Funds allow multiple investors to pool money to invest in larger property projects that they could not afford individually.

- Fund managers handle property selection, management, and maintenance, offering a hands-off investment experience.

- There are various types of real estate funds, such as REITs, private funds, mutual funds, ETFs, and crowdfunded platforms, each suited to different investor profiles.

- Investors enjoy diversification, passive income, liquidity (especially with publicly traded funds), lower entry barriers, and potential tax advantages.

- Investments carry risks such as market volatility, interest rate changes, liquidity restrictions in private funds, management fees, and economic downturn impacts.

- Real Estate Funds suit investors seeking regular income without managing properties, wanting diversification, or lacking large capital for direct property investment.

How Does a Real Estate Fund Work?

Step 1: Investors Pool Their Money

Many individual investors pool their money into one big fund. This allows them to invest in larger real estate projects they could not afford alone.

Step 2: Fund Manager Chooses Investments

A professional fund manager takes this pooled money and decides which properties to buy or finance, following a clear investment plan. This could include buying apartments, office buildings, shopping centers, or mixed-use developments.

Step 3: Fund Buys or Finance Properties

The fund uses the collected money to purchase real estate properties or provide property development financing.

Step 4: Properties Generate Income

The properties earn money by renting or leasing space to tenants, creating a steady income stream for the fund.

Step 5: Properties May Increase in Value

Over time, the value of these properties can go up, increasing the fund’s overall worth.

Step 6: Fund Distributes Earnings to Investors

The fund pays investors their share of earnings regularly. This can be:

- Rental income (distributed monthly, quarterly, or yearly)

- Profits from selling properties (capital gains).

Step 7: Investors Receive Returns

Investors get money as income or from property sales, without managing the real estate.

Types of Real Estate Funds

| Type | Description | Best For |

| REITs (Real Estate Investment Trusts) | Traded on stock exchanges. Regulated. Must share 90% of income. | Passive investors |

| Private Real Estate Funds | Not publicly traded. High entry. Managed by professionals. | High-net-worth individuals |

| Real Estate Mutual Funds | Invest in REITs or real estate-related stocks. | Small investors |

| Real Estate ETFs | Trade like stocks. Track real estate indices. | Investors wanting liquidity |

| Crowdfunded Real Estate Platforms | Online platforms that allow small-ticket investing in real estate. | Beginners and digital-savvy investors |

If you’re exploring direct property investment, working with a trusted real estate loan provider like Truss Financial Group can help you secure flexible financing for residential or commercial properties

Key Benefits of Real Estate Funds

1. Diversification

Investing in a real estate fund spreads your money across multiple properties and locations. This reduces risk because your entire investment is unaffected if one property underperforms or a local market faces issues.

2. Passive Income

You do not have to worry about managing tenants, collecting rent, or handling repairs and maintenance. The fund manager handles all property management tasks, making it a hands-off investment for you.

3. Liquidity

Unlike owning physical property, which can take months or years to sell, many real estate funds—especially publicly traded ones like REITs (Real Estate Investment Trusts) or ETFs (Exchange-Traded Funds)—can be easily bought or sold on stock exchanges. This provides you with quicker access to your money when needed.

4. Professional Management

Experienced professionals manage your investment, using their deep real estate market knowledge to make informed decisions about buying, managing, and selling properties to maximize your returns.

5. Lower Entry Barrier

Real estate funds allow you to start investing with a relatively small amount, sometimes just a few thousand rupees or dollars. This makes real estate investment accessible to people who cannot buy a whole property.

6. Potential for Regular Income and Growth

Besides earning rental income distributed as dividends, many real estate funds also benefit from the appreciation in property values over time. This dual source of returns can help grow your investment steadily.

7. Tax Advantages

In some countries, investing in real estate funds or REITs may offer certain tax benefits, such as dividend exemptions or favorable capital gains treatment, which can enhance overall returns.

Risks to Consider

1. Market Volatility

If you invest in publicly traded real estate funds like REITs, their prices can fluctuate with the overall stock market. This means your investment value may go up and down even if the real estate is stable.

2. Interest Rate Sensitivity

Real estate values often react to changes in interest rates. When interest rates rise, borrowing costs increase, which can lower demand for properties and cause prices to fall. This can affect the value of your investment.

3. Liquidity Issues

While public funds offer easy buying and selling, private real estate funds often lock your money in for several years. You cannot easily access or sell your investment during this lock-in period.

4. Management Fees

Some funds charge high fees for managing your money, including performance fees and administrative costs. These fees reduce your overall returns, so it is important to understand the fee structure before investing.

5. Economic Downturns

Economic recessions or local market problems (like job losses or natural disasters) can lead to lower rental income if tenants cannot pay or leave. Property values may also drop, impacting your investment returns.

Example of Real Estate Fund

Meet Anika. She wants to invest in real estate but does not have enough money to buy a whole building or the time to manage tenants.

So, Anika invests ₹50,000 in a Real Estate Fund, and 999 other investors pool ₹5 crores.

The fund manager invests this money to purchase a shopping complex located in a bustling city.

- The complex earns ₹30 lakh in rent yearly from shops and offices.

- After expenses like maintenance, property taxes, and management fees are paid, the net income is ₹25 lakh.

- All investors share this ₹25 lakh based on how much they invested.

- Since Anika put in ₹50,000, which is 1/1000th of the total fund, she gets ₹25,000 as her share of the rental income that year.

- Over time, if the property value goes up and the fund sells it for ₹6 crores, Anika will also get a share of the ₹1 crore profit proportional to her investment.

The best part?

Anika enjoys the benefits of real estate income and appreciation without dealing with tenants, repairs, or paperwork.

Who Should Invest in Real Estate Funds?

You should consider investing in a real estate fund if:

- You want regular income without becoming a landlord.

- You prefer passive investments over active management.

- You want exposure to real estate but lack large capital.

- You seek diversification in your investment portfolio.

Questions to Ask Before You Invest

- Is the fund public or private?

- What types of properties does it invest in?

- What are the entry/exit fees?

- How often are returns distributed?

- Who runs the fund, and how good is their past performance?

- What are the tax implications in your country?

Real Estate Fund vs. Direct Property Investment

| Feature | Real Estate Fund | Direct Property |

| Minimum Investment | Low (₹5,000–₹50,000) | High (₹10 lakh+) |

| Liquidity | High (REITs/ETFs) | Low |

| Diversification | High | Low |

| Time Commitment | None | High |

| Property Management | Handled by professionals | Your responsibility |

| Tax Handling | Automated | Complex |

Global Real Estate Fund Trends (2025)

1. Sustainability Focus: Funds will increasingly invest in green buildings and ESG-compliant (Environmental, Social, Governance) projects, prioritizing sustainability and responsible development.

2. PropTech Integration: Use AI, IoT, and data analytics to improve property selection and tenant management.

3. Affordable Housing Funds: Governments and private players are launching funds focused on low-income and middle-class housing to address shortages.

4. International Diversification: Some funds offer exposure to real estate markets in the US, Europe, Southeast Asia, and the Middle East.

5. Tokenized Real Estate Funds: Using blockchain to divide property into digital tokens, allowing micro-investments in global assets.

Action Plan for Beginners

1. Start Small: Begin with REITs or real estate ETFs.

2. Diversify: Mix REITs with mutual funds or crowdfunded platforms.

3. Track Performance: Use apps like Groww (India), Robinhood (US), or Fundrise (Global).

4. Reinvest Dividends: Use DRIPs to grow wealth.

5. Set Long-Term Goals: Use real estate funds for wealth-building, retirement, or children’s education.

Final Thoughts

Real Estate Funds are a smart way to invest in real estate without the headaches of owning and managing property. With low entry barriers, expert management, and diversification benefits, they suit beginners and experienced investors. However, like all investments, they carry some risks. Do your research, understand the fund’s strategy, and consult a financial advisor.

Understanding the obvious and hidden aspects of real estate funds can help you make confident, informed investment decisions.

Frequently Asked Questions (FAQs)

Q1. Can I invest in Real Estate Funds through a SIP (Systematic Investment Plan)?

Answer: Yes, some mutual funds that invest in real estate (like REIT-based mutual funds) allow SIPs. This helps investors build exposure gradually with smaller amounts, reducing risk through cost averaging.

Q2. Are returns from Real Estate Funds guaranteed?

Answer: No, returns are not guaranteed. They depend on property rental income, occupancy rates, property value appreciation, market conditions, and fund management decisions.

Q3. How are Real Estate Fund investments taxed in India?

Answer: The government taxes rental income distributed by REITs as regular income, and applies short-term or long-term capital gains tax when investors sell their units. Always check the latest tax rules or consult a tax advisor.

Q4. How do real estate funds perform during inflation?

Answer: Real estate funds tend to perform well during inflation because property values and rents often rise with inflation. This helps your investment keep its value over time.

Recommended Articles

We hope this article has helped you understand how Real Estate Funds work and whether they are the right fit for your investment goals. Check out the recommended articles below to dive deeper into real estate strategies, fund comparisons, and smart investing tips.

- Commercial Real Estate Investment Strategies

- Smart Financial Strategies

- Benefits of Using a Realtor

- Short Sale in Real Estate